PPA Funding Part 1

The Philadelphia Parking Authority has multiple priorities and goals that guide our daily operations. These goals include:

- Provide comprehensive on-street parking management services.

- Set standards of excellence and fair pricing through the construction and management of off-street parking facilities.

- Assist in presenting a first rate introduction to the region by providing attractive, user friendly, on-site parking facilities at the Philadelphia International Airport.

- Ensure safe, attractive, reliable taxicab, limousine and transportation network services through sound regulations and consistent enforcement.

- Improve traffic and pedestrian safety through automated red light camera enforcement at dangerous intersections.

- Apply new technology and continue professional staff development to ensure the highest quality public service and the greatest efficiency in all operations.

As we strive to accomplish these goals, and in accordance with the law, we are also responsible to provide revenue to the City’s general fund and Philadelphia School District.

How these funds are disbursed to the City’s general fund and Philadelphia School District can be confusing and complex to understand. With that said, we aim to explain how these funds are disbursed in the below FAQs:

What PPA Revenue Streams are Allocated for the City’s General Fund and Philadelphia School District?

By law, all of PPA’s on-street operations net revenue is allocated to the City’s general fund and Philadelphia School District. On-street operations revenue is generated from meter payments, permit fees, parking fines, vehicle auction proceeds and booting and towing fees.

How much of the PPA’s On-Street Revenue is given to the City’s General Fund and Philadelphia School District?

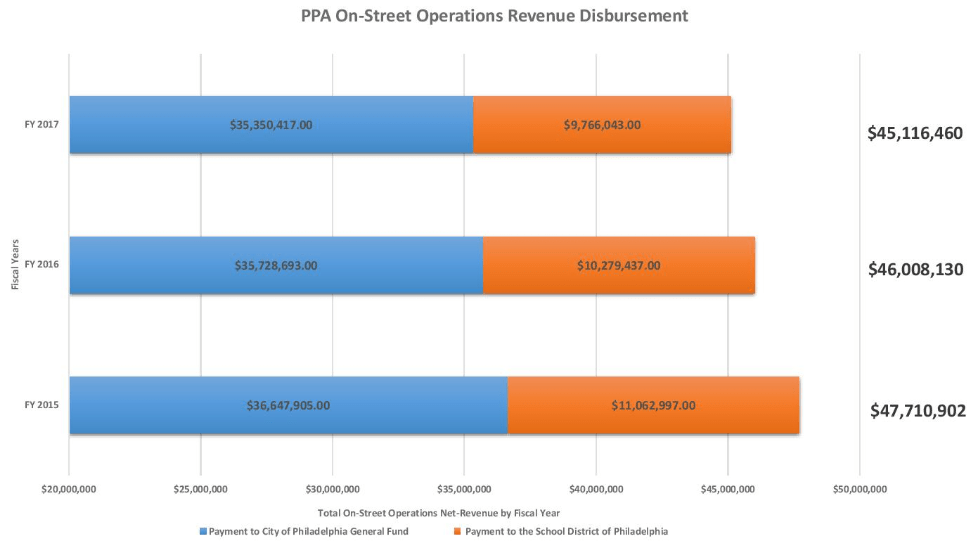

By law, each fiscal year the PPA is responsible to provide all net-revenue from on-street operations to the City’s General Fund and Philadelphia School District. In fiscal year 2017, we provided over forty-five million dollars ($45 million) to the City’s General Fund and Philadelphia School District.

How much of the PPA’s On-Street Revenue is forwarded to the City’s General Fund?

In 2014, the PA General Assembly set an annual minimum threshold of thirty-five million dollars ($35 million) to be disbursed to the City’s general fund. By law, it was also mandated that any percentage increase in gross revenue from on-street operations in a given fiscal year is applied to the total amount given to the City’s general fund. In Fiscal Year 2017 we contributed $35,350,417 to the City’s general fund.

Explain the “percentage increase” to me. What is it?

In 2014, the PA General Assembly’s legislation also provided a formula to annually raise the minimum amount of thirty-five million dollars ($35 million) given to the City’s general fund based off the prior year’s increase in gross revenue. That minimum has increased to over thirty-seven million dollars ($37 million) and can never drop, even during a decrease in on-street operations gross revenue due to weather emergencies or other factors.

In Fiscal Years 2015 -2017, less than thirty-seven million dollars ($37 million) was disbursed to the City’s General Fund. Why?

Beginning in fiscal year 2015, it was agreed that Bureau of Administrative Adjudication (BAA) expenses would be charged to the City (General Fund) so funding to the School District would not be affected. This resulted in an extra three million dollars ($3 million) being disbursed to the School District between fiscal years 2015 and 2017.

How much of the PPA’s On-Street Revenue is forwarded to the Philadelphia School District?

Also in accordance with the law, after the minimum is disbursed to the City’s general fund, the Philadelphia School District receives the remaining net-revenue generated from on-street parking operations. In Fiscal Year 2017 we contributed $9,766,043 to the Philadelphia School District. Unlike the City’s general fund, there is no minimum threshold amount disbursed to the Philadelphia School District.

Can the PPA designate how funds are distributed to the City’s General Fund and/or Philadelphia School District?

The Parking Authority has no say in how these funds are distributed. Mandated by statute according to Act 84, passed by the Pennsylvania General Assembly in 2012, all net revenues from on-street parking operations are disbursed to the City’s general fund and Philadelphia School District.

Is there a breakdown of how the funds were disbursed throughout the past fiscal years?

Yes, the chart below provides a breakdown of how funds were disbursed to the City’s General Fund and School District between fiscal years 2015 and 2017. Between fiscal years 2015 and 2017, an average of forty-six million dollars ($46 million) was disbursed to the City’s General Fund and Philadelphia School District.

Disclaimer:

The financial figures for Fiscal Year 2017 provided within are unaudited and are subject to change.

PHOTO CREDITS:

Towey Recreation Center: Malerie Yolen-Cohen